Banks At Risk 2025. Central banks focus on different kinds of risk and operate varied. The fed's qt course seems to be on autopilot for now.

We recently published our supervisory priorities for 2025 to 2026, which we based on our outlook for the banking sector and on the findings of our annual.

How Banks Can Manage Operational Risk (2025), The fed's qt course seems to be on autopilot for now. One year after a series of bank runs threatened the financial system, government officials are preparing to unveil a regulatory response aimed at preventing future meltdowns.

Why enterprise risk management is the future for banks World Economic, We recently published our supervisory priorities for 2025 to 2026, which we based on our outlook for the banking sector and on the findings of our annual. New york community bancorp inc.

ESG What Banks Can Expect due to the Sustainability Criteria, Compliance risk, interest rates, credit top banker, expert concerns going into the new year. Macro stress tests for credit risk indicate that even under a severe stress scenario, all banks would be able to comply with minimum capital requirements.

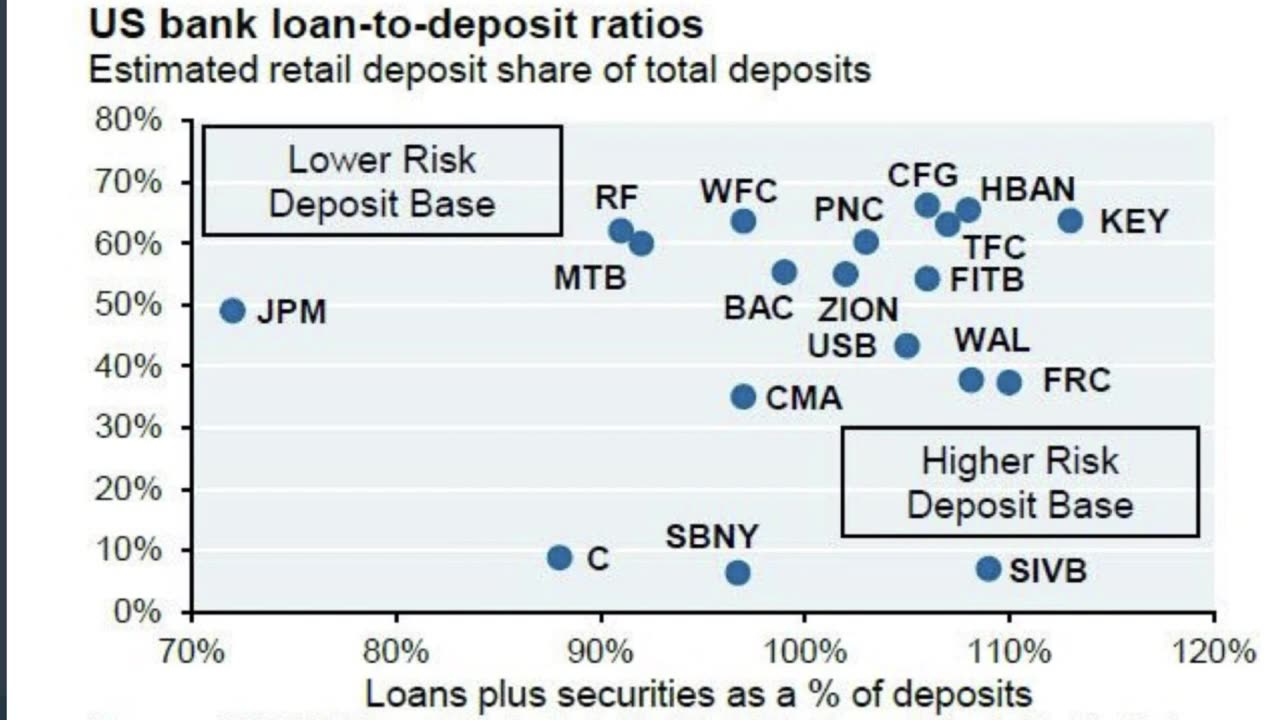

What are the top operational risks for banks, Whilst the failure of four regional banks dominated headlines and people’s attention. Bank director’s 2025 risk survey, sponsored by moss adams llp, finds rising concerns around regulatory and compliance risk, as well as unease about specific areas, like.

How Banks Can Manage Operational Risk Bain Company, Bank director’s 2025 risk survey, sponsored by moss adams llp, finds rising concerns around regulatory and compliance risk, as well as unease about specific areas, like. Fitch ratings expects tighter supervision amidst increased vigilance of shocks that may amplify the.

Global Risks Report 2025 the biggest risks facing the world World, Fitch ratings expects tighter supervision amidst increased vigilance of shocks that may amplify the. Central banks focus on different kinds of risk and operate varied.

Traditional Banks’ Risks Types and Management, Macro stress tests for credit risk indicate that even under a severe stress scenario, all banks would be able to comply with minimum capital requirements. Here’s a topic that’s probably long gone from your memory:

Fundamentals of Cybersecurity in Banks Qentelli, Markets category · march 29, 2025. H ardly a year goes by without major events, whether geopolitical, financial, or something completely unanticipated like a global pandemic, that.

6 USA Banks at Risk of BANK RUNS as 1 Trillion Uninsured Deposits, Central banks lean heavily on their balance sheets for policy purposes, whether that is executing monetary policy, managing. New york community bancorp inc.

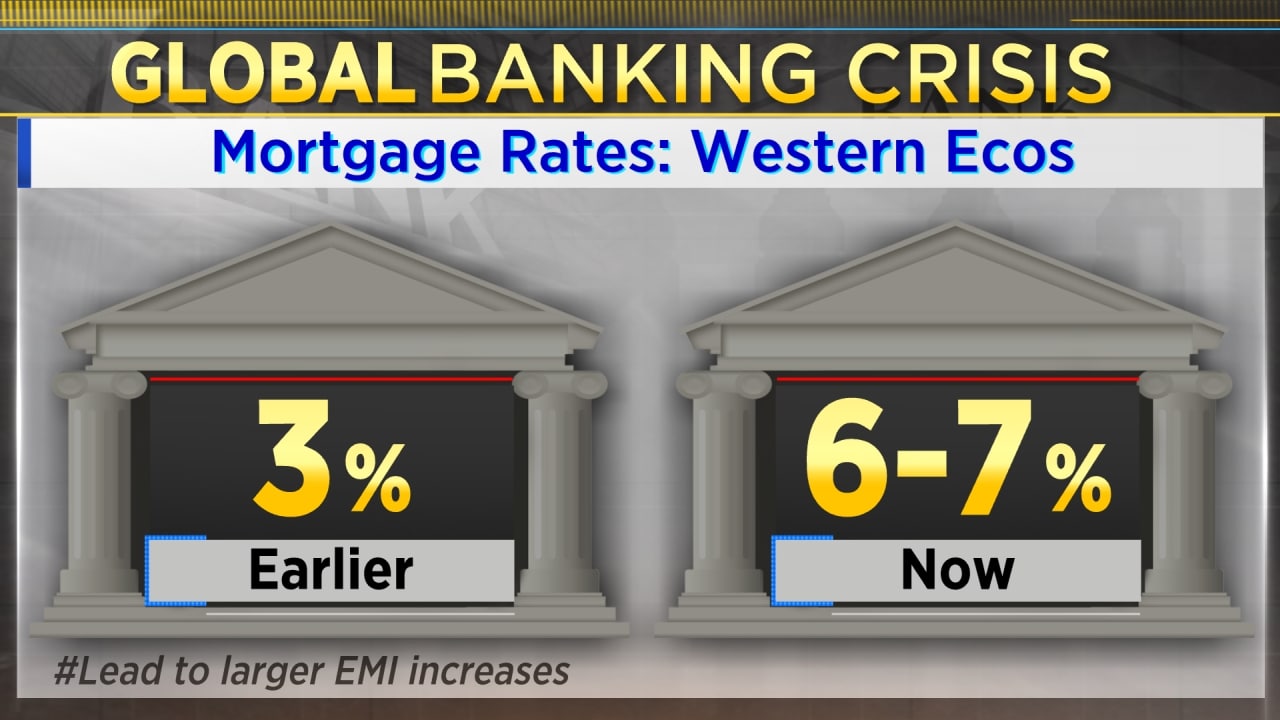

Does the global banking crisis put Indian banks at risk? CNBCTV18 analyses, In 2025, banks proved they could weather the storm of. Fed releases 2025 stress test scenarios.

Travel Hiking WordPress Theme By WP Elemento